India is the fastest growing major economy and the huge capex deployment by the Indian government promises large employment generation and the beginning of a fresh consumption cycle for India. Real estate is going to be a key sector to watch out for.

Is The Real Estate Sector On The Cusp of High Growth?

The real estate industry has seen many disruptions in the past few years, from demonetisation at the end of 2016 to the crisis with non-banking financial companies (NBFCs) to finally Covid, which hit supplies and demand. The introduction of the Real Estate (Regulations and Development) Act, 2016 (Rera), also posed challenges initially as does any new regulation in any space.

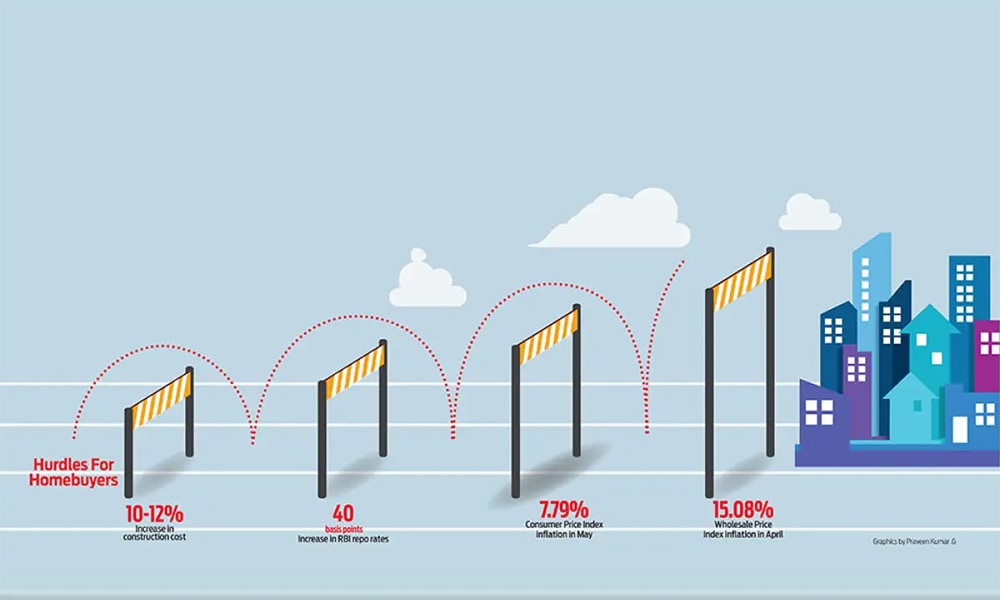

While hiccups remain for homebuyers such as rising interest rates and prices, the real estate industry is pegged for growth in the future, according to industry experts.

Here are the possible factors that have led to a huge transformation in the real estate investment banking industry.

Key Government Initiatives

The government’s focus is more towards making housing affordable and available for everyone. Changes in floor space index (FSI) rules made land hoarding unsustainable and almost finished land trading practices. Similarly, the government’s push for ‘Housing for All’ fuelled the demand for affordable housing and in turn generated much-needed liquidity in the sector.

After the introduction of Rera in 2016, the real estate sector has become more transparent and has boosted investors’ confidence. “Rera was a game-changer for real estate, as it brought much-needed transparency to the sector. Easy availability of information on project approvals and customer-centric court rulings have further given confidence to the market and buyers,” says Subhash Udhwani, chief executive officer, Elysium Capital, a boutique real estate investment banking firm.

Though some gaps such as implementation of Rera’s directions remain, experts believe it’s a step forward in the right direction.

Udhwani believes that revival of stalled projects through SWAMIH fund, creation of affordable housing fund with an initial corpus of about Rs 10,000 crore to fund housing finance companies (HFCs) in the priority sector, real estate debt restructuring, and moratorium benefits during Covid times were few key initiatives by the central government in recent times that have fuelled the growth of the industry.

Streamlining of Processes

The real estate sectors have seen transformational changes in the last few years both at the Centre and State level which has streamlined the process. “RERA, GST implementation, and streamlining of approval processes are the steps in the right direction and have helped reduce associated risks in lending to this sector. Additionally, state-specific changes like moderation of ready reckoner rates, rebate in stamp duty, and other charges have been a welcome move for the industry,” says Udhwani.

Opportunity Areas

This is the most pertinent question which every investor asks before investing in real estate. According to Elysium Capital Research, new hubs of development are emerging in cities like Indore, Chandigarh, Dehradun, Vizag, Jaipur, and Surat. These cities are creating a lot of opportunities.

Also, post Covid, hybrid mode of work has created migration of skilled workforce to satellite cities, which has further fuelled demand in these cities. New industrial and travel corridors, cheap manpower, easier supply chain, and logistics management, and cheaper cost of living and doing business are making these cities attractive in the long term. “I firmly believe that satellite cities around metros and tier II cities will see major traction in the real estate business and would witness unprecedented growth in the coming decade,” adds Udhwani.

However, homebuyers should analyse other factors before getting into any deal.